Similar analysis may be applied to options on films re the valuation of film studios. Unlike other accounts that record actual transactions, a valuation account is used to adjust the value of an asset or liability based on changes in market conditions or internal factors. Inventory Valuation Accounts are crucial for accurately assessing the value of goods held in stock at any given time.

Full-time on-site position located at our company’s headquarter offices in Boca Raton, Florida.

Plugging it back into the original equation, the percentage equals the cost of capital. You could then imagine that Tesla might have a cost of capital of 20 percent and a growth rate of 17.2 percent. Market capitalization is one of the simplest measures of a publicly traded company’s value. It’s calculated by multiplying the total number of shares by the current share price.

Next PostWhat Happens if You Don’t Do Your Accounting?

Amortization is the same as depreciation but for things like patents and intellectual property. One of the shortcomings of market capitalization is that it only accounts for the value of equity, while most companies are financed by a combination of debt and equity. One of the most straightforward methods of valuing a company is to calculate its book value using information from its balance sheet. Below is an exploration of some common financial terms and financial valuation techniques used to value businesses and why some companies might be valued highly despite being relatively small. It’s easy to become overwhelmed by the number of valuation techniques available to investors when you’re deciding which valuation method to use to value a stock for the first time.

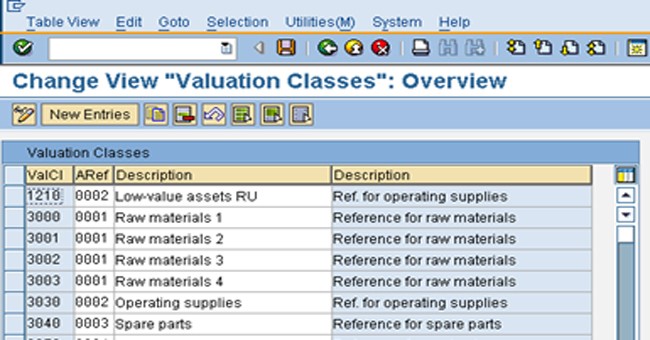

Examples of Valuation Accounts

By recording the exact amount of liabilities owed by the company, it assists in providing a clear picture of the company’s financial obligations. Various types of valuation accounts exist in accounting, including Inventory Valuation Accounts, Asset Valuation Accounts, and Liability Valuation Accounts. Growth not only measures a company’s current achievements but predicts its future potential. Companies viewed as growth leaders attract investors willing to pay a premium for the promise of future returns. This is especially true in industries where innovation leads to market disruption. In normal accounting, if a company purchases equipment or a building, it doesn’t record that transaction all at once.

Let’s review enterprise values—a more accurate measure of company value that considers these differing capital structures. DCF approaches to valuation are used in pricing stocks such as with dividend discount models like the Gordon growth model. If their balances are quite small, they may be merged for presentation purposes with the account with which they are paired, so that you do not see a line item for them. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The benefit of a valuation account is that the amount in the main account is not changed, since the needed adjustment(s) are contained in a separate account.

Valuation accounts are utilized in accounting to adjust the book value of assets or liabilities to reflect their fair value, historical cost, or current market value. Company valuation, also known as business valuation, is the process of assessing the total economic value of a business and its assets. During this process, all aspects of a business are evaluated to determine the current worth of an organization or department. The valuation process occurs for various reasons, such as determining sale value and tax reporting. An analyst would compare the P/E ratio with other companies in the same industry and with the ratio for the broader market if the P/E ratio of a stock is 20 times earnings.

From the prices, one calculates price multiples such as the price-to-earnings or price-to-book ratios—one or more of which used to value the firm. For example, the average price-to-earnings multiple of the guideline companies is applied to the subject firm’s earnings to estimate its value. In finance theory, the amount of the opportunity cost is based on a relation between the risk and return of some sort of investment.

- Startup companies such as Uber, which was valued at $50 billion in early 2015, are assigned post-money valuations based on the price at which their most recent investor put money into the company.

- When a firm is required to show some of its assets at fair value, some call this process “mark-to-market”.

- Let’s work out net asset value for Alphabet Inc. (GOOG), the parent company of search engine and advertising giant Google.

- Understanding this trajectory is vital for leaders and investors, as it goes beyond current financials to envision future potential.

Securities the firm owns for its own investment portfolio versus trading will have their own rules for valuation as well, as will bonds held for investment or trading. In accounting, a valuation account is usually a balance sheet account that is used in combination with another balance sheet account in order to report the carrying amount or carrying value of an asset or liability. In this example, a company began operations in Year 1 and incurred an operating loss in Year 3. The tax rate is 25% for all years and the only temporary differences are taxable temporary differences related to depreciable assets that are subjected to alternative deprecation rates for tax versus book purposes.

The application of FIFO in inventory valuation can lead to higher reported profits during periods of rising costs, as newer, more expensive inventory remains in stock, influencing financial statement presentations and overall business performance. The FIFO method in valuation accounts values inventory by assuming that the first items purchased are the first ones sold, impacting cost accounting and financial reporting. We will explore the different types of valuation accounts, such as inventory, asset, and liability valuation accounts, and examine examples like FIFO and LIFO methods. We will discuss the impact of valuation accounts on financial statements and weigh the advantages and disadvantages of using them in business operations. The benefit of discounted cash flow analysis is that it reflects a company’s ability to generate liquid assets. The challenge of this type of valuation, however, is that its accuracy relies on the terminal value, which can vary depending on the assumptions you make about future growth and discount rates.

They play a crucial role in accurately reflecting the true financial position of a business. By adjusting the values of assets and liabilities, valuation accounts help in providing a more realistic picture of the company’s net worth and performance. This adjustment ensures that the balance sheet presents a fair representation of the company’s financial health. On the income statement, changes in valuation accounts can impact reported profits, as they influence the calculation of expenses and revenues. In the cash flow statement, these adjustments are essential for accurately portraying the inflows and outflows of cash related to changes in asset values. This adjustment process ensures that financial statements accurately represent the economic reality of the company, providing stakeholders with a clear picture of the company’s financial health.