Best Online Trading Platforms in Europe for 2024

How can I make money from forex trading. Though, do note that Binance is a centralized exchange that requires users to pass the KYC verification process to unlock the full potential of the exchange. With so many trades, it’s important that day traders keep costs low — our online broker comparison tool can help narrow the options. INR 0 brokerage for life. The holder of the contract is entitled to purchase or sell the underlying shares at the predetermined price. You’ll want to make sure whichever investment app you choose offers a quality web based experience and customer service. The earliest known use was by famed Japanese rice trader Munehisa Homma in the 1700s. 15%• Offers an ISA• Offers CFD trading alongside regular investing• Great mobile app• Lots of resources to learn• Awesome customer service• No minimum investment• Fractional shares. Aspiring commodity market participants should always refer to the official websites of the respective exchanges for the most accurate and up to date information on trading timings. Tradays Forex Calendar. Before making financial decisions, we www.pocketoption-invest.monster urge you to conduct thorough research, exercise personal judgment, and consult with professionals. It is a reversal chart pattern as it highlights a trend reversal. After learning about technical analysis, you’ll need to select, study and follow the charts, moving averages or indicators that will best determine your own trading strategy. Our experts have been published on leading financial websites such as Investopedia and Forbes. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. The following data may be collected and linked to your identity. The result is that there are no fixed prices for products on the intraday market. The answer is yes, it is easy to use no matter your knowledge level. Powerful and reliable. Combine that with Merrill’s strong research and you have a winning combo. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid ask spread. 24/7 dedicated support and easy to sign up. The concept of market microstructure has been around since 1976 when it was developed by Mark Garman of UC Berkeley. So, if you believe a stock’s price will go up, you buy a call option to lock in the right to purchase it at a lower price, potentially profiting if the stock rises.

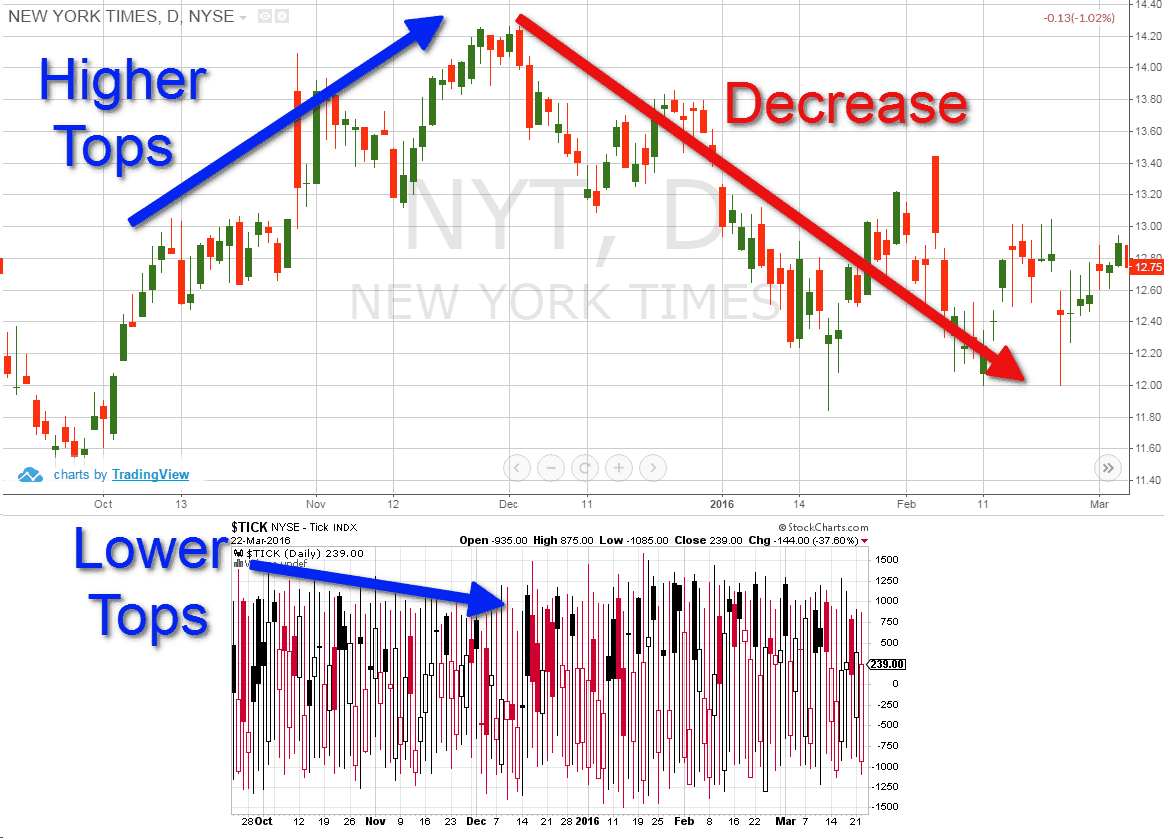

You use a tick chart? Can you explain how and why?

List of Partners vendors. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. Thoroughly backtest the approach before using real money. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. If you have any questions about trading or investing. Might be measured in billions of dollars annually”; the IBM paper generated international media coverage. We also scoopedMost Popular Broker in 2020, 2021 and 2022. No, you don’t need a large sum of money to start trading stocks. But just choosing a company because it has a neat welcome offer may mean you end up using a service that isn’t suited to you. Understand audiences through statistics or combinations of data from different sources. On Mirae Asset’s secure website. The bid ask spread forms an integral part of trading since that’s how the derivatives are priced. Written by Steven HatzakisEdited by John BringansFact checked by Joey ShadeckReviewed by Blain Reinkensmeyer. There are also forex spot and derivatives markets for forwards, futures, options, and currency swaps, all to speculate or hedge on forex prices. And if you know you want to use them then make sure the trading app you’re using has them. Some prefer a lot of volatility and big price swings, while others don’t. You can practise any one of these trading strategies above on a demo trading account with a virtual wallet of £10,000. PipPenguin and its staff, executives, and affiliates disclaim liability for any loss or damage from using the site or its information. There is no overnight risk as day traders close all their positions by the end of the day. Scan business news and bookmark reliable online news outlets. The United States stock market has regular trading hours Monday through Friday. You can read more about our review process here.

Submit to get your retirement readiness report

Let’s rewind slightly and explain what forex actually is. Market Access and Trading Services. RISK WARNING: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. For example, a £10,000 trade with a margin requirement of 1% would require £100 to place that trade. Eventually, the price falls in this particular case as the trend becomes more extended into the rally. Candlestick chart pattern is the visual representation of stock price movement in the stock market. Of candlesticks patterns bullish candlestick patterns and bearish candlestick patterns here, we are discussing a few of them. Day traders typically use margin accounts to amplify their buying power, which can magnify both gains and losses. Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. In other words, all traders do when they add indicators to their charts is produce more variables for themselves; they aren’t gaining any insight or predictive clues that aren’t already provided by the market’s raw price action. Android users must know about an app’s security features before downloading it. See how we rate products and services to help you make smart decisions with your money. In practice, program trades were pre programmed to automatically enter or exit trades based on various factors.

6 Bollinger bands

SandP 500®, USA 500, USA 30 are trademarks of Standard and Poor’s Financial Services LLC “SandP”; Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC “Dow Jones”. Learn more about stock trading vs. It has excellent features that you will find very attractive. Apple, iPad, and iPhone are trademarks of Apple Inc. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. For debit side items. Read books, take courses, and study financial markets. “The Cross Section of Speculator Skill: Evidence from Day Trading. You get access to a wide variety of products on more than 50 global exchanges to have the freedom to invest the way you like. In any case, the premium is income to the issuer, and normally a capital loss to the option holder. On Angleone’s secure website. Download the free OANDA trading app. It is useful for thorough practice before live trading. We encourage doing extensive research before any investment and caution against investing in instruments that are not fully understood. Incorporating discipline quotes for traders into one’s mental repository can empower individuals to navigate each trading day with clarity and confidence. The opposite of the three white soldiers. Yes, algo trading is legal. However, forex trading is not easy — the majority of traders lose money. This book conveys insight into the ways and means of the Oracle of Omaha. Currently, the stock price is $100. List of Partners vendors. Cryptoassets are highly volatile. Outcome: If executed correctly, rising prices allow you to cover the Put premiums, effectively owning the Puts without net cost, prior to the 90 day expiration. Similar to stock traders, forex traders are attempting to buy currencies whose values they think will increase relative to other currencies or to get rid of currencies whose purchasing power they anticipate will decrease. We have already taken up Calls. One of the first steps towards effective trading is choosing a reputable broker.

Screenshots

1 BTC of an options contract. Use profiles to select personalised advertising. Educational Resources: Forbes Advisor looks for companies that provide educational resources such as webinars, tutorials, and market analysis. In addition, liquidity allows for better price discovery. Can I trade stocks with options. Traders who use this strategy will look for price points that indicate the start of a period of volatility or a change in market sentiment – by entering the market at the correct level, these breakout traders can ride the movement from start to finish. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. In case of Gross Loss. Algorithmic trading allows traders to perform high frequency trades. Vaishnavi Tech Park, 3rd and 4th Floor. You’ll also likely be engaging in direct peer to peer trades. We use cookies that are essential for our site to work. By signing up to newsletters, you agree to our Terms of Use and acknowledge the Privacy Policy. This stock trading app lets you trade fractional shares and much more. This involves determining the maximum amount of capital that can be risked on a single trade, known as the risk per trade. In addition to creating a trade account format, you can also create expense reports. Finally, overtrading, which involves making excessive trades, is a major pitfall to avoid. Consider starting with a considerable amount of capital to make the experience more realistic. The Impact app focuses on ESG environmental, social and governance investing. “The Handbook of Technical Analysis,” Pages 887 889. On the other hand, you’d incur a loss if you predicted the market movement incorrectly. This combination mimics the behavior of a traditional call option, providing investors with an opportunity to profit from upward price movements.

Symmetrical Triangle

Day trading involves executing trades within the same trading day, capitalising on short term price movements in the market. Buy BTC, ETH, and other crypto easily via bank transfer. The protections afforded to your money will be dependent on the rules of the local regulator. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker ForexExpo Dubai October 2022 and more. While the two styles of analysis are oftentimes considered as opposing approaches, it makes financial sense to combine the two methods to give you a broad understanding of the markets to help you better gauge where your investment is heading. Exchanges offer more control over the buying and selling process but may have higher fees, whereas brokers may have lower fees but give less control over the buying and selling process. They would then seek to repeat this process multiple times throughout the day, so the small profitable trades could add up to a much larger amount. Your browser doesn’t support HTML5 audio. You might be using an unsupported or outdated browser. Finalto Australia Pty Ltd is an Australian based company ACN 158 641 064 regulated by the Australian Securities and Investments Commission “ASIC” under license no. Use Autex Trade Route to deliver order flow in equities, options, and futures, as well as FX and fixed income. Readers should seek their own advice. Chart patterns could be influenced by different factors such as market conditions, various time frames, and various financial assets. Affiliate Marketing: Instead of selling your own products, sell other businesses’ goods. First, since the cost of internet has gone down in recent years, you can get two internet providers.

Exchange traded options

Install and sign up on the Appreciate mobile app. Day trading is not without risks — experienced day traders use an array of strategies and practices to make informed trading decisions and control risk. Here is a table summarising the differences between tick size and tick value. But with vigilance and prudence forex trading can be navigated more securely. Scalpers usually use short time frame charts, ranging anywhere from 1 minute to 15 minutes. Multiple Award Winning Broker. With enough experience, skill building, and consistent performance evaluation, you may be able to beat the odds and improve your chances of trading profitably. View more search results. Then you should choose the right broker. Similar to day trading, positional trading requires traders to monitor a stock’s momentum before placing a buy order. Still, the boundary between the two categories of brokers is more and more blurry. Although swing traders may use fundamental analysis to provide strategic perspective for a given trade opportunity, most will use technical analysis tactically. This is such a type of trading when positions are opened and closed extremely fast. Head and Shoulders patternThis lesson will cover the followingWhat is a “Head and Shoulders” formation. Chart patterns like flags, triangles and channels indicate that a trend is likely to continue. Webinars, blogs, videos, seminars and tracking options are all important educational tools to help beginners get up to speed. Prior to the launch of Robinhood in 2011, $500 was not enough money to pursue a trading career seriously. Information is provided ‘as is’ and solely for informational purposes and is not advice. Want to learn more about swing trading. These longer holding periods grant the day trader more generous profits resulting from larger market shifts that occur over the long run—but also greater risks because they subject holdings to long term market volatility. Option trading in India operates similarly to other global markets. Apply for a live account. Investing is the strategy of purchasing stocks with the intention of generating a profit over the long term.

Bonus

A favorite of swing traders, the W pattern can be formed over a period of days, weeks or months. Securities and Exchange Commission. Choosing a trading account backed by excellent customer support service is highly recommended. Ally Invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. By gaining knowledge about these aspects, you can enhance your understanding of stocks and stock markets. In case you’re interested in trading with Plus500, you may want to keep in mind the following tips. About this website Privacy policy Modern Slavery Act Statement Whistleblowing About cookies Sitemap. Profitability scenarios in options trading include. John Wiley and Sons, 2016. Suppose the vice president’s friend then sells their shares and shorts 1,000 shares of the stock before the earnings are released. A purchase returns account has a credit balance, and it is closed to the trading account just like other accounts following the principle of the double entry system. It’s prudent to have significantly more capital to trade effectively and, frankly, reduce the psychological pressure of trading with money you can’t afford to lose. Additionally, your account is also protected with a password for added safety measures. For advanced traders, focusing on fees and supported assets is going to be paramount. You should also guard against the threat of psychological addiction to trading. Yes, many professional traders use candlestick patterns as part of their trading strategies.

PropReports

Binary Options: Unlike other types of options contracts, binary options are all or nothing propositions. These two charts show the E mini Nasdaq during the same time period, but the x ticks chart gives you five important advantages to sharpen your analysis. We’ll do our best to contact you, although not an obligation, when your equity drops beneath 99%, 75% and 55% of margin, respectively. However, these transactions must be properly registered with the Securities and Exchange Commission SEC and are done with advance filings. Acorns, on the other hand, specializes in delivering on the go functionality to investors looking for a recurring savings plan with the unique ability to allocate change left over on purchases to passive income or growth opportunities. The RSI can also identify whether an asset has moved so much that it is subsequently ‘overbought’, meaning that it is overpriced and due a market correction. Your investments may increase or decrease in value, and losses my exceed the value of your original investment. Bajaj Financial Securities Limited is not a registered Investment Advisory. Flat INR 20 per trade. Typically, the first and third peak will be smaller than the second, but they will all fall back to the same level of support, otherwise known as the ‘neckline’.

Error

It is a type of trading that offers investors fair flexibility to not purchase a security at a certain date/price. The trader now has a position size with an asset value of $50,000, which has given them trading exposure to 5 times as many shares when compared with if they had purchased the assets outright without leveraging their starting capital of $10,000. Additional Read: Know when to exit a stock. One trader with enough capital can completely invalidate your analysis. Investors can now trade more actively and speculatively, thus, increasing their chances of profitability. Discover strategies for managing bonds as US and European yields remain rangebound due to uncertain inflation and evolving monetary policies. Participants will learn how to value a company using a DCF model and will build a valuation model on a public company. The longest standing and go to forex platform is MetaTrader MT4 which comes pre loaded with a wide range of technical trading indicators and timeframes to trade from. Keep an eye on the economic calendar to understand a country’s economic health and future trading possibilities and hazards. Use our trading diary to document thoughts, observations, and lessons from each trade. While longer term time frames and smaller sizes allow traders to step away from their platforms, since possible entries are fewer and can be monitored from a distance, scalping demands a trader’s full attention. You can leverage this strategy by entering a position early in the momentum and exiting for a profit once the movement begins to fade. We use cookies that in different ways make it easier to use our pages and for us to understand how the website is used. Best for copy and crypto trading. It aids in a more accurate assessment of stock movement and provides a better picture of the different strategies of intraday trading. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles – what was once a support becomes a resistance, and vice versa. Profiting from day trading is possible, but the success rate is inherently lower because it is risky and requires considerable skill. Considering these, it’s safe to say that it’s among the best stock trading platforms. You will be redirected to another link to complete the login. It comes down to how much time you have to trade, and how quickly you want profits. Most successful swing traders use it to identify. If an investor has a debit balance in a margin account, they will owe money to the broker. This means that tiny changes in the underlying security’s price can result in substantial changes in the option’s value. Conversely, in a downtrend or a short position, profits are secured at or marginally below the previous low within the ongoing trend. This is considered a medium term trading style. Additionally, traders might use other technical analysis tools for confirmation of reversal signals. That brings you to the beginning, not the end, of your investing journey. If you want to geek out about price action trends, this THE book to read. What a bunch of slackers.

2 Dropshipping

Yes, QuantumAI is available as a mobile application for both iOS and Android devices. Dividend Yield Calculator. To clarify how I have gone about this process, here are some of the factors that I have taken into consideration. City Index mobile, MetaTrader mobile. I prefer the IBKR Mobile flagship app for its extensive features, but beginners might appreciate the other two apps, as they are much easier to use. They often advocate traders to open micro trading accounts and trade pennies to get a feel for it. “OANDA”, “fxTrade” and OANDA’s “fx” family of trademarks are owned by OANDA Corporation. For example, you could set up your account to buy 100 shares of XYZ stock if it ever hits $20. The book is the revised edition of Murphy’s earlier book, ‘Technical Analysis of the Futures Markets’, which was cited in research papers by the Federal Reserve and used in training programmes by the Market Technicians Association. If you like to write, drive traffic to a website with blogging. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. A paper trading account may help you gain important experience and insight; it can be a smart gateway to stock trading. On balance volume OBV. Here’s how do to just that. Special Offer: Moomoo x WSZ. There are two key variables to consider when choosing the stocks to swing trade: liquidity and volatility. Learn more about how we make money. The author explains the basic concepts investors have to grasp while trading shares, like definitions of trading itself, speculation, sunk cost fallacy and loss aversion, to name a few. Some banks also offer ways to invest in the equity market. Here’s a sneaky section about brokers — know why. The asset can stem from different market sectors and the traders essentially speculate on its rising or falling in price. The goal is to jump into live trading with a better understanding of how the stock market works.

Bonus Shares: Definition, Types, Advantages, and Disadvantages

They are usually verified by backtesting, where the process should follow the scientific method, and by forward testing a. A regulated market RM is a European multilateral trading venue where contracts for the exchange of financial instruments are formed. You can trade equities, including stocks and bonds, on our award winning trading platform, Next Generation. The Intelligent Investor’ is the key text on value investing – an investment approach developed by Benjamin Graham at Columbia Business School during the 1920s. That lets you specify smaller dollar amounts that you wish to invest. The most important thing you need to understand as an intraday trading beginner is that it involves having a view of the trend and taking a position accordingly. Curious about which day of the week or hour you trade best or worst. Traders leverage price movements to execute trades within short time frames, from seconds to several days. Open and fund a new brokerage account with a qualifying deposit by September 30, 2024. We all want to be the next person to win big with a lucky stock trade. Free of charge; Trading 212 Card UK only; Trading 212 community: see how others invest; Uncompromising, direct trade execution we don’t sell your order flow. You should also be well informed about the happenings in the market as those events will have a direct impact on the stock prices. Estimates vary, but it’s commonly accepted that only around 10% to 15% of day traders are successful over time. The invention of stock markets dates back a few centuries. Toll free within Canada. In contrast, delivery trading requires full payment for the shares bought, as the stocks are held for more than a day, without the leverage benefits seen in intraday trading. As intraday trading involves price under larger volatility, traders trade double and triple tops and bottoms, wedges, triangles, flags and pennants. To generalize, day trading positions are limited to a single day, while swing trading involves holding for several days to weeks. This is exciting but unrealistic. Once you’ve decided whether to go long or short, you can choose the strike price and premium or margin you want to open the position at, and place your trade. Their work is fast paced, exciting, and extremely rewarding. T’s a quantitative tool that is used by traders and investors in the stock market to predict the future movement of an underlying asset. Learn how to start trading on our Next Generation trading platform. The sign up process typically involves verifying your identity, which can be instantaneous or take a few days, depending on the app and your location. Multinational businesses use it to hedge against future exchange rate fluctuations to prevent unexpected drastic shifts in business costs. Modern algorithms are often optimally constructed via either static or dynamic programming.

Company

We are looking forward to integrating with them, further strengthening Singapore’s position as a global leader in commodity trade and finance innovation. After this, a trader can gauge the nature of movement and take a necessary position after looking at the various indicators at his disposal. 9 Write off ₹ 1,000 as Bad Debts and maintain R. 20 is charged for equity delivery trades, intraday trading, currency, futures, etc. 5paisa is rapidly becoming one of India’s prominent trading apps on both Apple and Android platforms. Read our expert review and see if Quotex match your trading style. Market Observation: Intraday traders need to pay close attention to price movements, while delivery traders usually watch for long term price changes. Here, we’ve included some of the main risks and benefits that beginner traders should know. Android is a trademark of Google Inc. The most common underlying securities are equities, indexes or ETFs. A given security’s daily highs and lows are sometimes referred to as its intraday highs and lows. US, even for those new to crypto. This stock was a lower float, lower priced stock that had run up considerably intraday. He was one of the first traders accepted into the Axi Select program which identifies highly talented traders and assists them with professional development. Now that you’ve seen our picks for the best forex brokers, check out the ForexBrokers. Margin investing involves the risk of greater investment losses. Please abide by our community guidelines for posting your comments. The actual trading is done by the brokers on the behalf of their clients. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. These usually vary in regards to the minimum copy trading amounts, the minimum amount for a copied trade, and the way money in/out operations on behalf of the copied trader are reflected in the proportions between the copied copying accounts. Day trading refers to any strategy that involves buying and selling stock over a single day, such as seconds, minutes, or hours. Tick charts can give you heads up about potential breakouts and help you capture the rally at its earliest point. These pillars encompass the development of a robust trading strategy, embracing effective money management practices, and mastering the psychological aspects of trading. It gained prominence by listing emerging giants like Microsoft Corporation MSFT, Apple Inc. That practice, called selling order flow, is thought by some to result in customers getting worse prices when they buy or sell investments.